How Outsourcing Dental Billing Can Save Time and Boost Your Practice's Revenue

In this dynamic and every changing dental billing industry, the challenges posed by dental billing can be complex ranging from fulfilling insurance intricacies to compliance with ever-changing regulations. For many dental practitioners, this is a time-consuming task that takes them away from what truly matters caring for patients and growing the business.

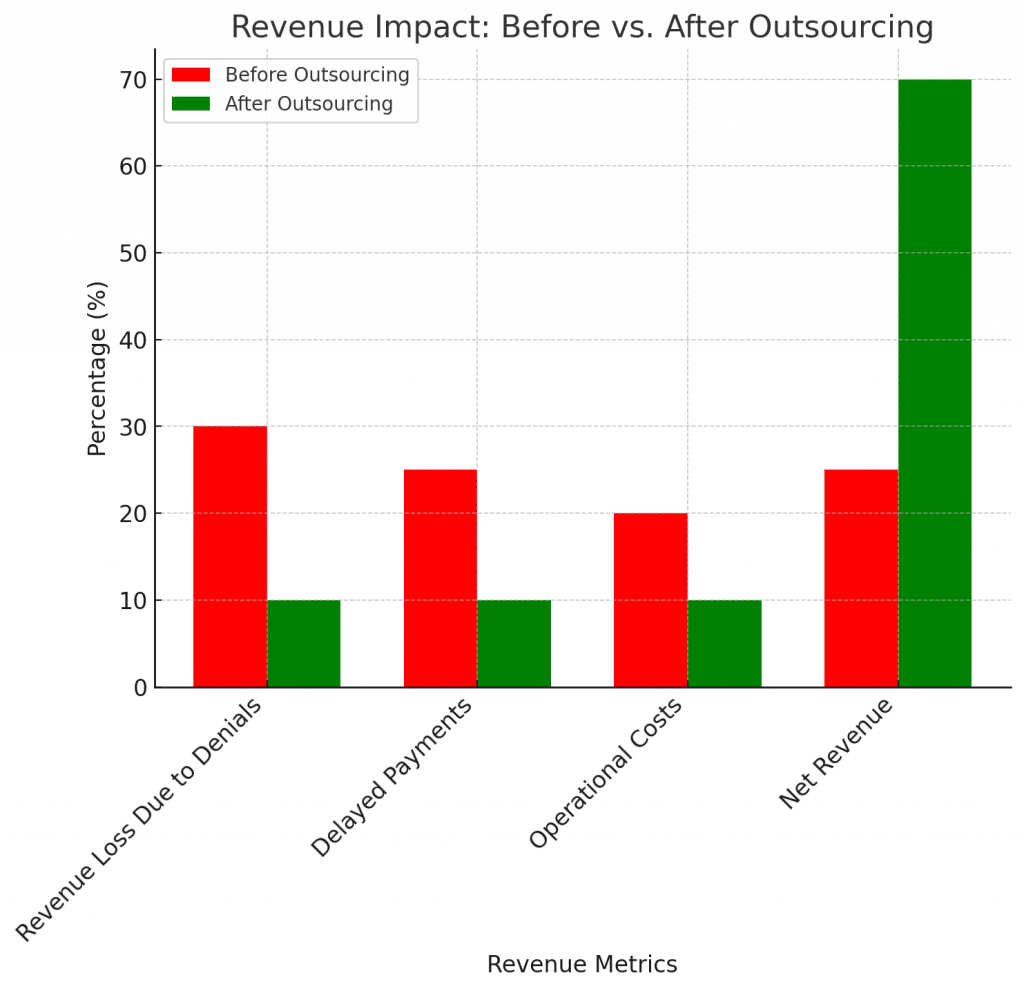

Dental practitioners are increasingly leveraging the benefits offered by outsourcing their non-core or dental billing functions as it increases cash flows, provide better patient care, streamlines operations, and reduces account receivables.

Managing a dental practice involves many responsibilities, and billing process is one of the critical areas to be handled efficiently. A well-structured billing process optimized to handle granular requirements helps alleviate insurance claims grievances, revenue loss, instances of denied claims, and non-compliance with regulations.

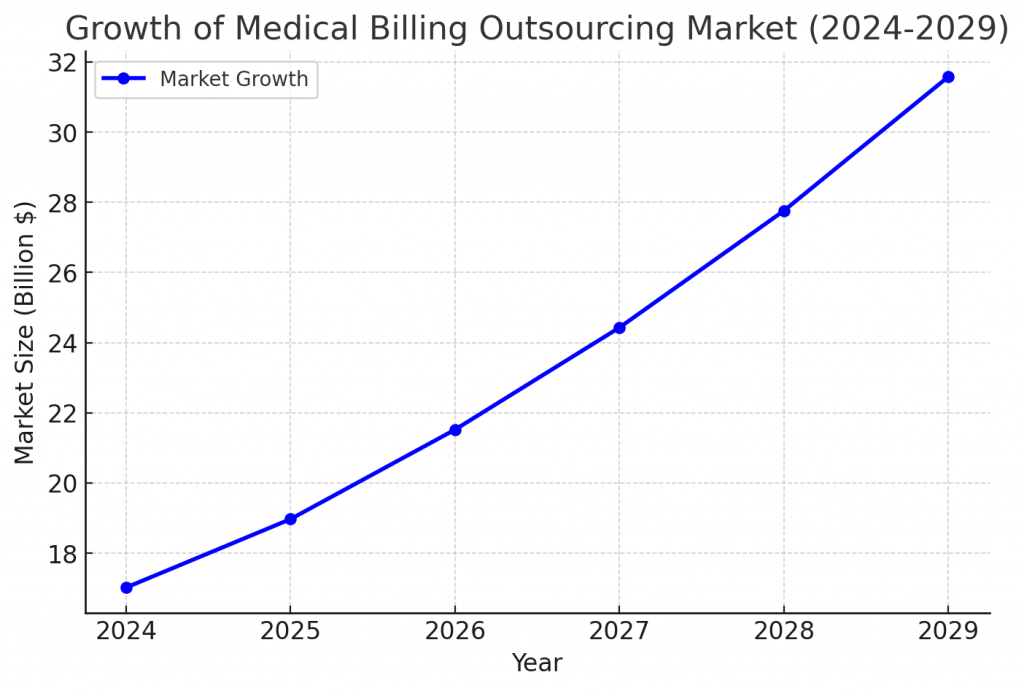

Also, the medical billing outsourcing market is forecast to surge from $17.02 billion in 2024 to $18.97 billion in 2025, representing an 11.5% compound annual growth rate (CAGR). The projections also estimate the industry will be valued at $31.58 billion in 2029, growing at a CAGR of 13.6%. (source)

Outsourcing dental billing is a smart solution that can help save time, reduce overhead costs, and ultimately boost your practice’s revenue. Here’s how you can get help with dental bills.

Why In-House Billing is Not Viable?

Dental practitioners have to extensively rely on staff members to handle various responsibilities like account receivables, insurance coverage, patient information or treatment documentation and more.

Some of the challenges in in-house billing include:

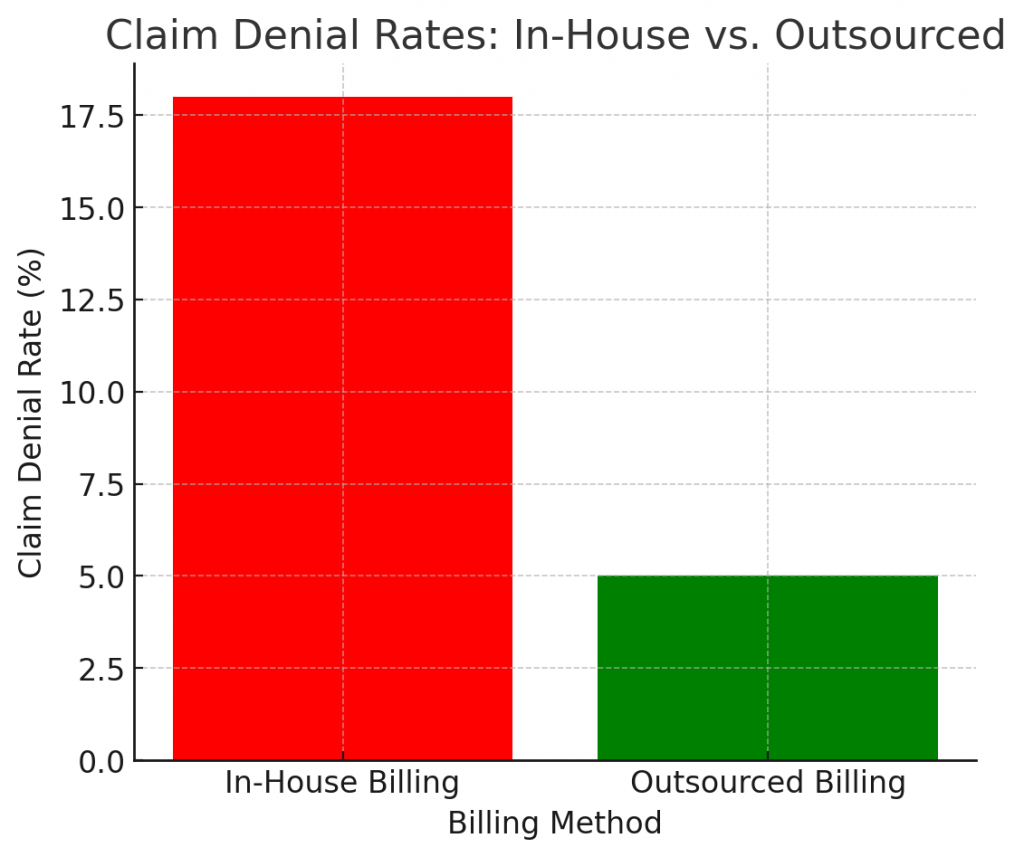

- Inefficiency in revenue recovery: Many staff members are not trained in dealing with various intricacies of insurance adjustments, PPO contracts write-offs and more. Lacking experience in handling these processes, inefficient handling can result in significant revenue loss for the dental practitioner.

- Continuous coding updates: Changes in dental billing codes like Current Dental Terminology (CDT) and Current Procedural Terminology (CPT) codes for dental services requires staff to constantly monitor and educate themselves for smooth claims and reimbursement process.

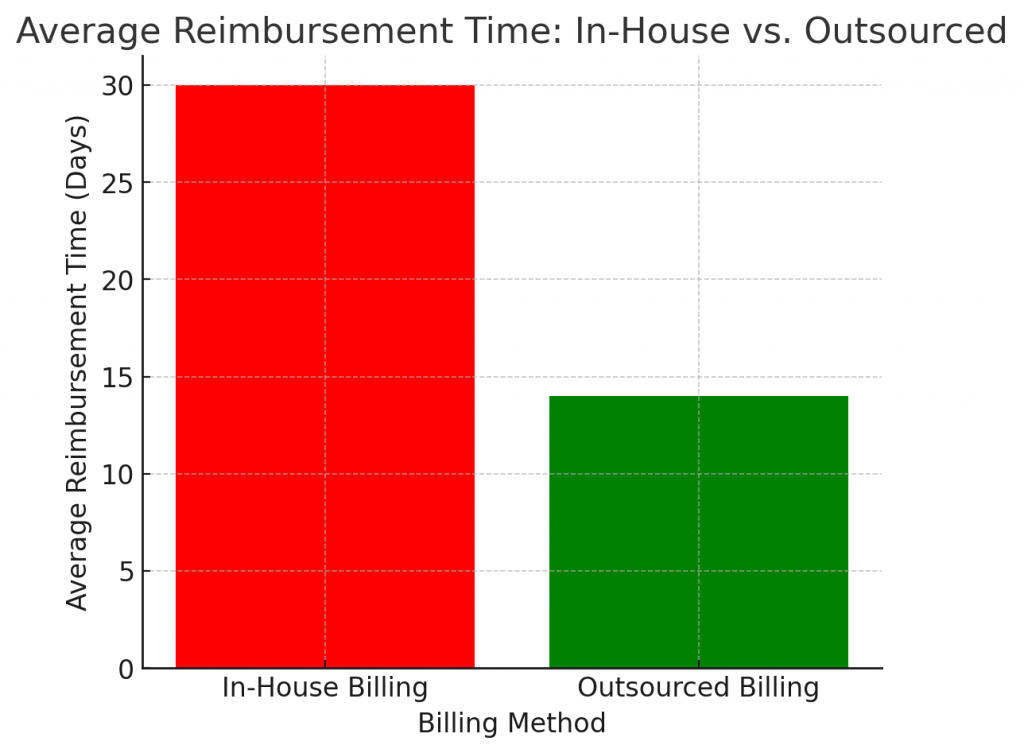

- Handling claims and billing process: Handling insurance claims denial and appeals can be quite time-consuming and daunting process for the in-house staff members. Changes in dental insurance policies, issues related to coverage limits, co-payment terms can be overwhelming and can delay payments. Even, inaccurate billing can lead to revenue loss and issues in passing of claims.

- Staffing challenges: With more staff working towards handling insurance claims, proper coding documentation for patients, many core functions like patient interaction and handling their issues get hampered.

Benefits of Outsourcing Your Dental Billing (source)

Outsourcing dental billing offers plethora of advantages as mentioned below:

- Reduce Administrative Burden

One of the biggest benefits of outsourcing dental billing is the reduction in administrative workload. Billing is often a detailed and repetitive process. It includes verifying insurance details, submitting claims, checking codes, following up on unpaid claims, and handling denials. With remote dental billing, you eliminate the need for in-house staff to dedicate hours to these tasks, freeing them up to focus on patient care.

- Increase Accuracy and Efficiency

With dental billing experts handling the process, you’re more likely to see fewer errors in claim submissions. Outsourcing firms specialize in dental billing, accurate documentation and have extensive knowledge of codes, insurance policies, and regulations. This expertise reduces the chances of mistakes that could result in claim denials or delays, helping you get paid faster.

- Faster Reimbursement

Outsourcing companies are equipped with the latest tools and technologies to streamline the billing process. They are also proactive in following up on claims, ensuring that reimbursements are processed more quickly. Faster dental insurance reimbursements mean less time spent chasing down payments and more money in your practice’s bank account.

- Stay Compliant with Regulations

Dental billing has to comply with strict regulations, such as HIPAA, ADA, and insurance provider guidelines. Outsourcing billing to a trusted partner ensures that your practice stays compliant with these regulations. Billing experts stay updated on any changes in rules and codes, maintain audit helping your practice to avoid costly fines or penalties.

- Improve Cash Flow

When your billing is handled efficiently and accurately, cash flow improves. Even outsourcing ensures that claims are submitted in a timely manner, and follow-ups are made on outstanding payments. This means fewer delays and interruptions to your revenue stream, allowing your practice to focus on growth.

- Cost-Effective

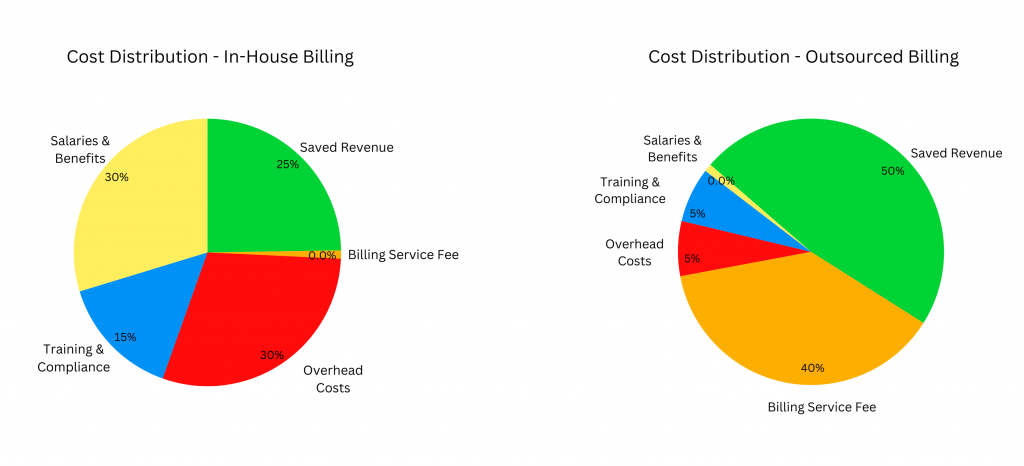

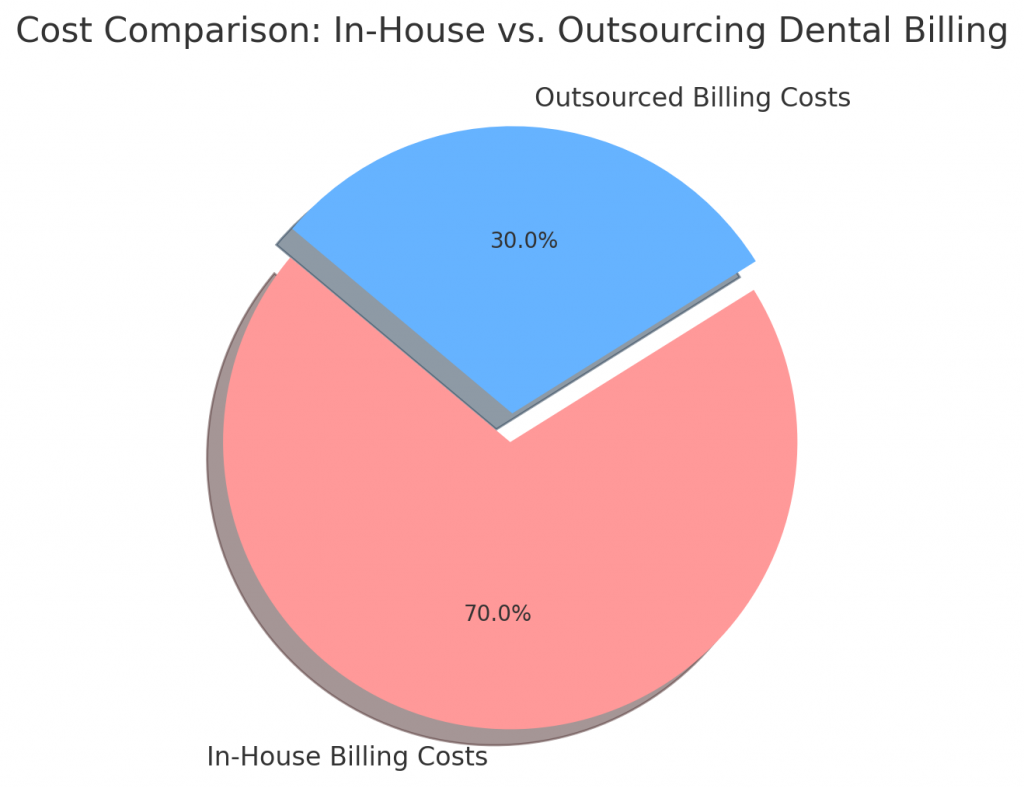

Hiring in-house billing staff can be expensive considering giving them salaries, benefits, training, and overhead costs. Outsourcing eliminates these expenses, offering a more cost-effective alternative. Even according to one survey, 70% of the businesses save on their expenditure using outsourcing. You only pay for the services you need, with no need to worry about additional expenses related to hiring and managing a billing team.

- Focus on Patient Care

By outsourcing the billing process, you and your team can focus on core functions that matter most — providing excellent patient care. With less time spent on administrative tasks, you’ll be able to enhance the patient experience, build stronger relationships, and improve retention.

- Scalability and Flexibility

As your practice grows, the volume of billing and insurance claims will likely increase. Outsourcing provides scalability and flexibility, allowing you to manage higher volumes without the need to hire additional staff. Billing companies can easily adapt to your changing needs, ensuring that your practice remains efficient and streamlined.

- Time Zone Advantage

One key advantage of outsourcing to India is the time zone difference, allowing insurance verifications to be completed before the business day even begins in the US and Canada. This ensures a seamless workflow, reduces delays, and accelerates claim processing. giving your practice a competitive edge.

In-House Billing vs. Outsourcing: A Quick Comparison

| Aspect | In-House Billing | Outsourced Billing |

| Revenue Recovery | Prone to errors and delays | Optimized for maximum collection |

| Compliance | Staff must stay updated | Experts ensure regulatory compliance |

| Cost | Salaries, training, overhead expenses | Cost-effective pay-per-service model |

| Time | Staff burdened with paperwork | More time for patient care |

Conclusion

Outsourcing dental billing is a smart move for dental practices looking to save time, increase revenue, and reduce administrative burdens. With the expertise of billing professionals, your practice can improve accuracy, speed up reimbursements, and maintain compliance, all while freeing up resources to focus on patient care. By delegating billing to an outsourcing partner, your practice can grow and thrive in a competitive market.