Ever get hit with a tax bill that catches you off guard? It’s a common concern among business owners and individuals. Taxes are complex, and working with the right tax advisors can make all the difference. Whether you’re a high-earning individual, a startup founder, or a small business tax advisor yourself, the approach you take proactive or reactive can significantly affect your financial future. At shivohm, we understand the importance of choosing the right strategy to stay ahead.

Proactive vs. Reactive Tax Advisory: Choosing the Right Approach for Your Business

So, do you proactively plan ahead or reactively fix problems later? Let’s break down both approaches and why choosing the right one matters.

Proactive vs. Reactive Tax Advisory: What’s the Difference?

Proactive tax advisory is about anticipating tax obligations, preparing year-round, and leveraging opportunities to minimize tax liability. It’s strategic and forward-thinking—something a seasoned financial tax advisor or tax planning advisor can help you build into your operations.

In contrast, reactive tax advisory deals with tax issues only as they arise. Think filing tax returns at the last minute, responding to IRS notices, or fixing errors. It’s more about damage control than planning.

Why Choosing the Right Tax Strategy Matters

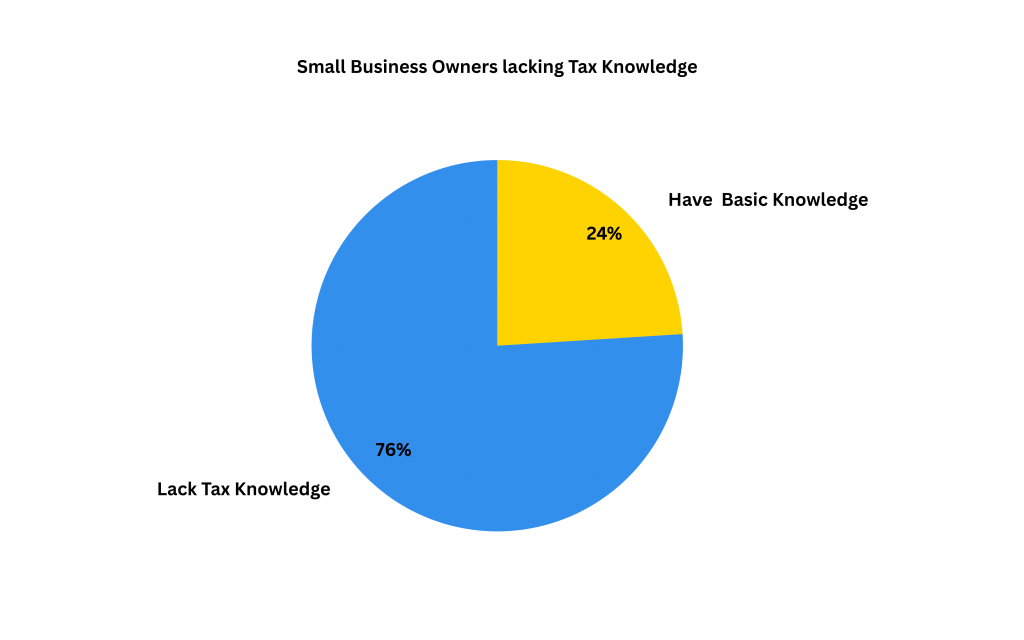

According to The American University, 76% of small business owners lack basic tax knowledge, putting them at risk for late filings, missed deductions, and potential IRS penalties.

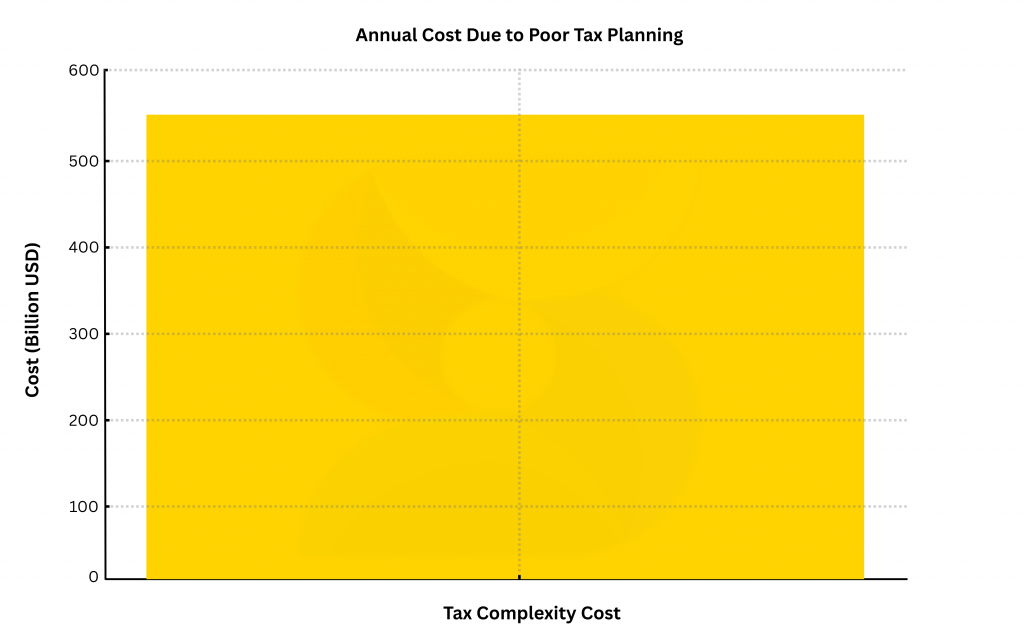

Moreover, in another study, poor tax planning and the complexity of the federal tax code cost Americans over $546 billion annually.

Understanding Reactive Tax Advisory

What is Reactive Tax Advisory?

Reactive tax services are like changing a tire after a blowout. You’re working with what’s already happened. A financial and tax advisor offering reactive services typically focuses on:

- Filing tax returns

- Responding to IRS letters

- Assisting with audits

When Does Reactive Work?

- For very simple tax situations

- When new laws catch businesses off guard

- For startups or sole proprietors with minimal compliance needs

Reactive services can also cost less upfront, making them appealing to newer businesses. However, the cost of missed opportunities often outweighs initial savings.

Downsides of Being Reactive

- You miss chances for tax savings

- There’s a higher risk of penalties

- You lack a long-term strategy

- No support for cash flow or growth planning

The Value of Proactive Tax Advisory

What is Proactive Tax Advisory?

Proactive planning is like charting a road trip checking routes, budgeting gas, and avoiding tolls. A proactive tax planning advisor will guide you through:

- Monitoring changes in tax law

- Planning business decisions with tax implications in mind

- Maximizing deductions and credits

- Reducing year-end surprises

Major Benefits of Going Proactive

- Significant tax savings

- Smoother compliance

- Better cash flow and financial health

- Support for wealth creation and business growth

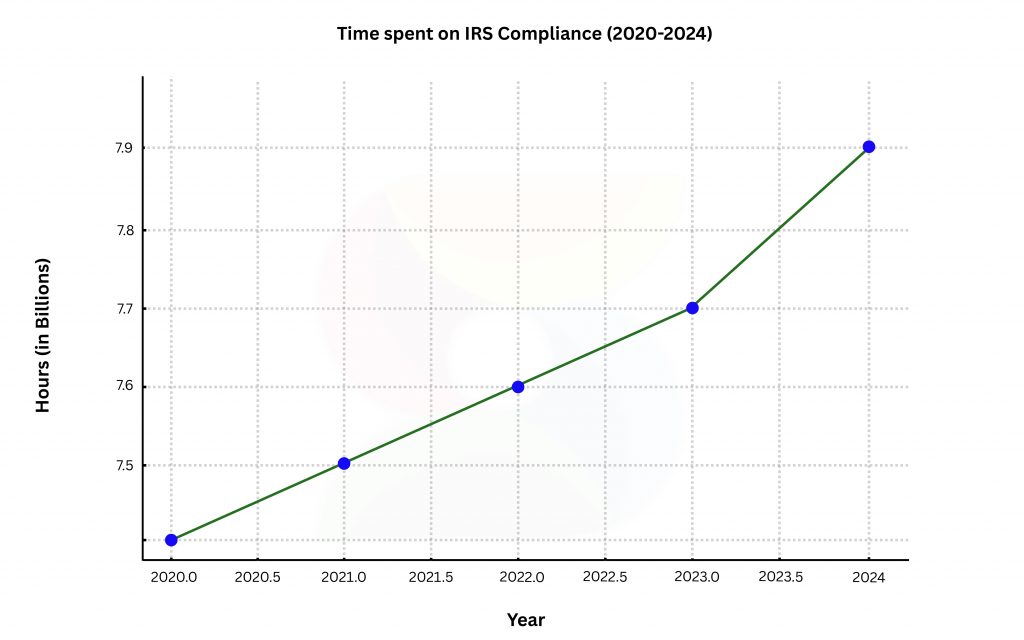

The White House Office of Information and Regulatory Affairs (OIRA) estimates Americans will spend 7.9 billion hours on tax compliance in 2024. Hiring a financial and tax advisor who offers proactive services can dramatically cut this time and improve productivity.

Implementing a Proactive Tax Strategy

Whether you’re a growing business or a high-income individual, hiring a small business tax advisor with a proactive approach helps you:

- Understand complex tax regulations

- Plan major expenses or business expansions strategically

- Optimize timing for deductions

- Align tax strategy with financial goals

A proactive tax advisor doesn’t just save you money, they help you build a stronger financial future.

Key Differences: Proactive vs. Reactive

Aspect | Reactive Tax Advisory | Proactive Tax Advisory |

Timing | After issues arise | Year-round, ahead of time |

Focus | Compliance & fixes | Strategy, optimization & savings |

Data Used | Historical (past data) | Forward-looking (projections & plans) |

Services | Filing, audits, IRS responses | Strategic planning, forecasting, deductions |

Business Impact | Minimal savings, more stress | Improved cash flow, lower tax bills, growth |

Choosing the Right Tax Advisor for Your Needs

When selecting a business tax advisor or financial tax advisor, ask:

- “Do you offer year-round proactive planning?”

- “How do you stay updated on tax law changes?”

- “Can you share case studies where you’ve saved businesses money?”

Look for credentials, experience, and a proactive mindset. Don’t settle for someone who only works with numbers during filing season opt for a partner who supports your business all year.

Conclusion: Take Charge of Your Taxes

Taxes are inevitable, but surprise tax bills and missed savings aren’t. With the right tax planning advisor, you can shift from reactive to proactive, improve profitability, reduce stress, and unlock opportunities for growth.

So, think about your current tax setup. Could you benefit from a more proactive approach? The right tax advisors can transform how you manage your finances. At shivohm, we’re here to help you take control today and position yourself or your business for long-term success.